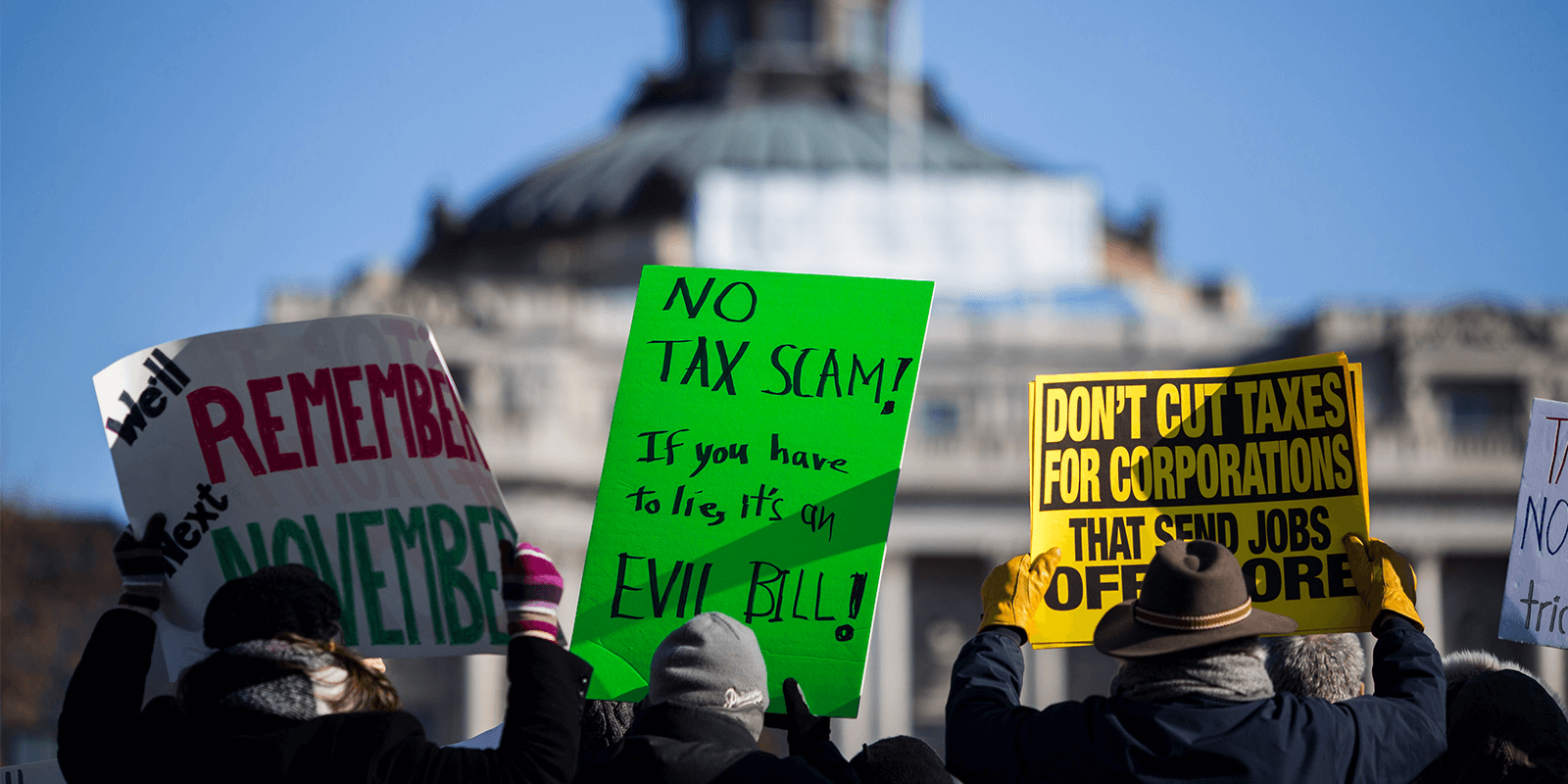

President Donald Trump and the congressional majority rushed to pass the 2017 Tax Cuts and Jobs Act in December 2017, leaving very little time for public scrutiny or debate.

AFSCME warned back then repeatedly that the tax “reform” bill will hurt working people. We pointed out that the bill would “not only shortchange working families but also enrich the big corporations that make generous campaign donations to politicians who do their bidding.”

Here are a few things we’ve learned since the GOP tax bill became law:

1. It Will Encourage Outsourcing: An April 2018 report by the nonpartisan Congressional Budget Office confirms that two "provisions [of the GOP tax bill] may increase corporations’ incentive to locate tangible assets abroad."

2. It Has Not Increased Corporate Investment: The rate of investment growth has stayed pretty much the same as before the GOP tax bill passed.

3. Few Workers Are Being Helped: Only 4.2 percent of workers are getting a one-time bonus or wage increase this year, according to Americans for Tax Fairness.

4. Corporations Are Keeping the Windfall: Americans for Tax Fairness says corporations are receiving nine times as much in tax cuts as they are giving to workers in one-time bonuses and wage increases.

5. Corporations Are Using the Windfall to Buy Back Stocks: Corporations are spending 37 times as much on stock buybacks, which overwhelmingly benefit the wealthy, as on one-time bonuses and wage increases for workers, according to Americans for Tax Fairness.

6. Corporations Are Laying Off Workers: Americans for Tax Fairness calculates that 183 private-sector businesses have announced 94,296 layoffs since Congress passed the tax bill.

7. It Costs More Than We Thought: The GOP tax bill will eventually cost $1.9 trillion by 2028, according to an April 2018 report by the nonpartisan Congressional Budget Office. And we know some advocates will call for cuts to entitlement programs – Medicare, Medicaid and Social Security – to pay for it.

8. We’ve Fallen Behind When It Comes to Corporate Tax Revenue: Thanks to the tax law, estimates for corporate tax revenue (as a share of the economy) will be lower in the United States than in any other developed country, according to an April 2018 report by the Institute on Taxation and Economic Policy.

9. Extending the Individual Tax Cuts Would Benefit the Wealthy: The GOP tax bill’s temporary tax cuts for individuals expires by 2025, and some in the congressional majority are now proposing to extend them. An April 2018 report by the Institute on Taxation and Economic Policy shows that 61 percent of the benefit from these extending individual tax cuts would go to the richest one-fifth of taxpayers.

10. It Is Shoddy Work: In March 2018, a leading tax expert concluded that the GOP tax bill’s new rules for pass-through businesses "achieved a rare and unenviable trifecta, by making the tax system less efficient, less fair and more complicated. It lacked any coherent (or even clearly articulated) underlying principle, was shoddily executed and ought to be promptly repealed."

11. It Is Still Unpopular: The GOP tax bill still polls poorly, with a clear majority disapproving.

12. The Outsourcing Incentives Can Be Fixed: In February 2018, Sen. Sheldon Whitehouse (D-R.I.) and Rep. Lloyd Doggett (D-Texas) introduced the No Tax Breaks for Outsourcing Act, which would eliminate the GOP tax bill’s incentives for outsourcing by equalizing tax rates on domestic profits and foreign profits.