Would you trust Wall Street to provide vital public services to the most vulnerable members of your community?

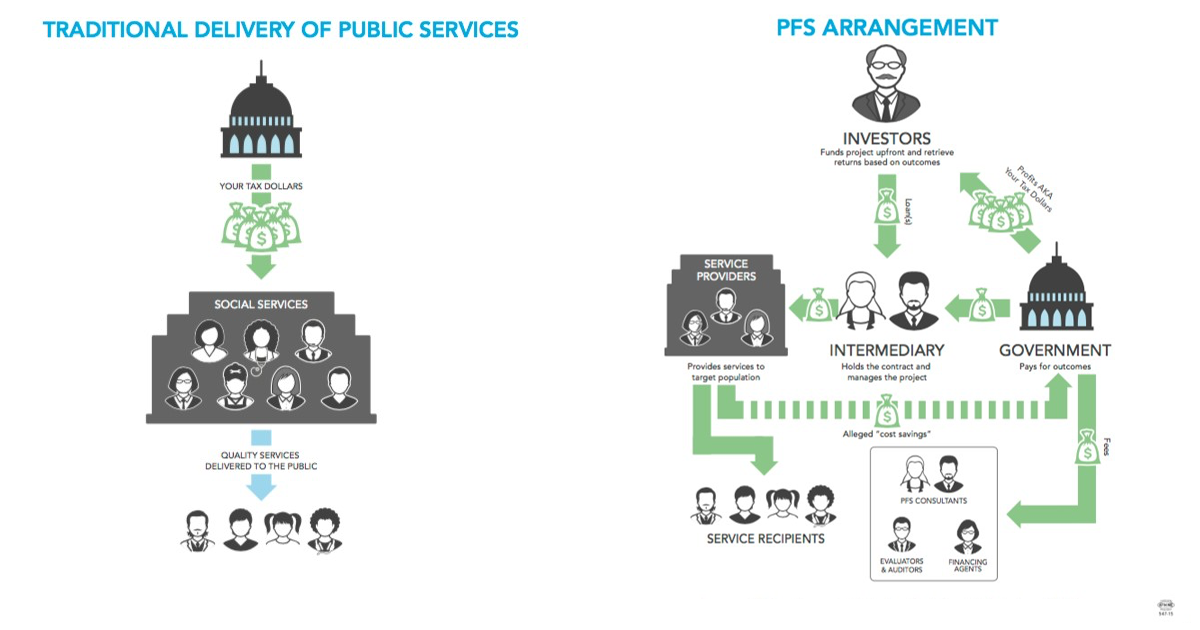

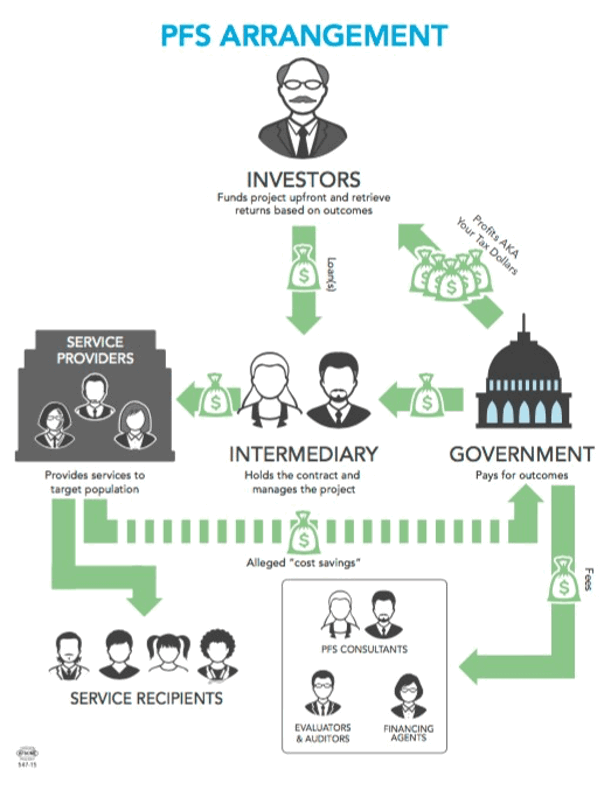

As local and state governments look to cut budgets, some governments are partnering with big banks to pursue alternative funding schemes called “Pay for Success” contracts (PFS), also known as Social Impact Bonds (SIBs), to pay for critical, yet underfunded, services. Under a PFS arrangement, private investors lend money to local or state governments. The loan is later repaid with interest by the government with taxpayer dollars if pre-determined goals are met.

But there is no such thing as a free lunch, and according to a new guide to evaluating PFS Contracts and SIBs co-authored by AFSCME, these schemes lack transparency, assign risk to the public and show no evidence of making services better and more efficient. In addition, measuring outcomes is very difficult.

For instance, take a PFS contract between Goldman Sachs and a local Utah school system to increase access to pre-K. The goal of the contract was to prevent “at-risk” children from needing special education later in kindergarten. But, as The New York Times reports, while Goldman Sachs cashed in on $260,000 of public money, questions arose about irregularities in how the bank was measuring its supposed success.

Goldman Sachs, which was being paid per at-risk child, claimed it prevented 99 percent of at-risk children in its program from needing special education in kindergarten. But that staggering success rate raised a red flag among experts who noted that even well-funded programs produce success rates at half of what Goldman Sachs reported, meaning faulty criteria was used in identifying children “at-risk” of needing special education without pre-school.

In other words, the bank was likely cashing in on students who were never “at-risk” at all, and shouldn’t have been factored into their reporting. Yet, the bank was still receiving large payouts of taxpayer money.

The lack of transparency and difficulty measuring outcomes in this case, coupled with another failed PFS contract at Riker’s Island Prison in New York to reduce recidivism, raise serious concerns about governments’ Pay for Success deals with big banks. Instead of pursuing these complex, shady schemes, governments should try a much simpler solution: invest in schools and services that citizens need.