This is a story from beyond the grave, a frightful tale of how the wealthiest Americans are able to keep their assets tax-free long after they are in their graves, thanks to laws written to help the rich stay that way – forever.

In a fascinating new article for The Nation magazine, Mike Konczal, a fellow at the Roosevelt Institute, writes about a legal method the very wealthy can use to keep the IRS away from money they leave to their heirs. Great for them, perhaps, but a drain on revenue the country needs to spend on public services, to maintain infrastructure and to remain strong.

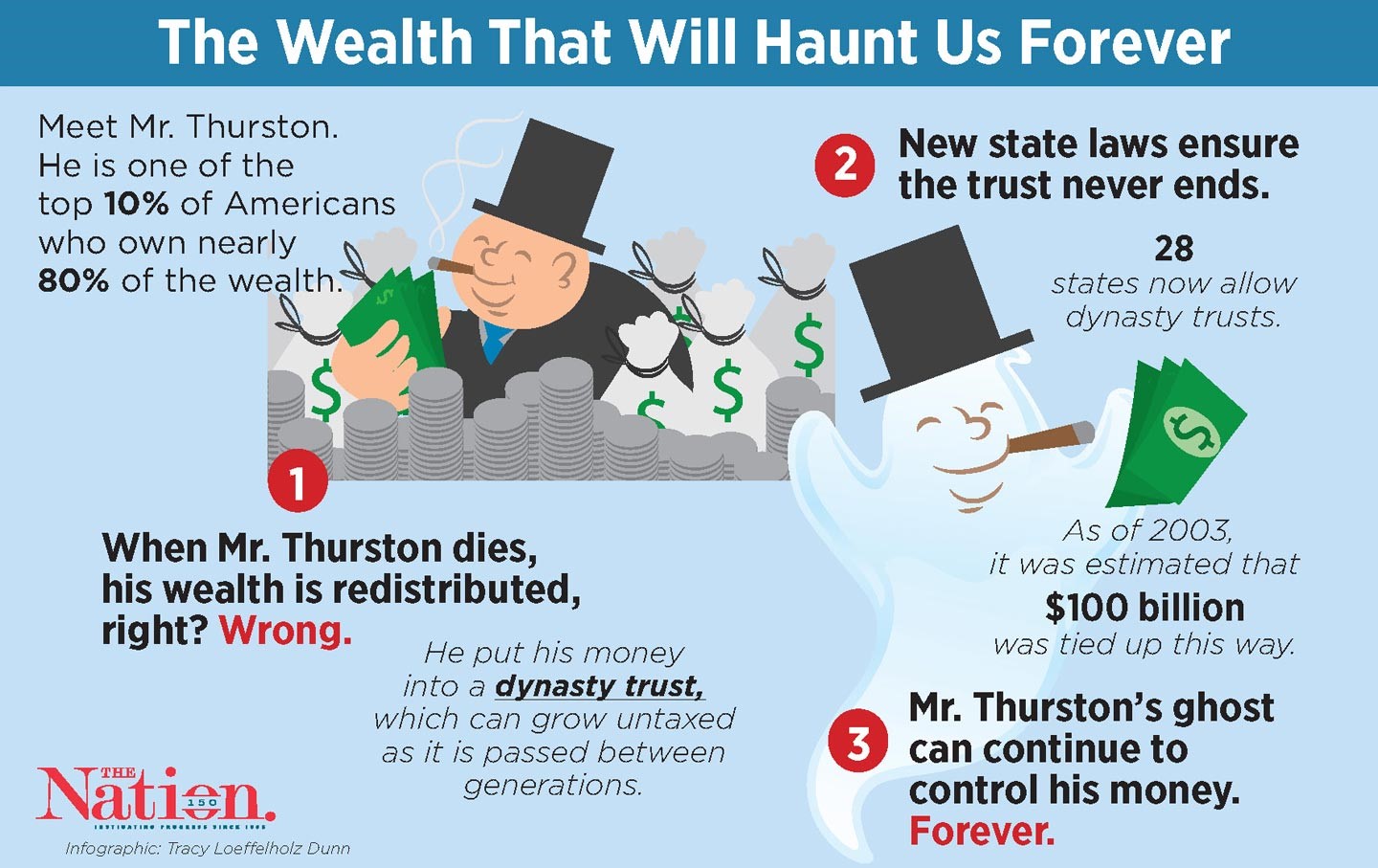

Here’s how this clever tax-avoidance scheme works, according to Konczal:

“Americans have, historically, had a simple approach to dealing with wealth after its holder dies: You can do whatever you want with your property, but not for very long. … Eventually, time catches up with them and their estates dissolve. Or at least that’s how it used to be. Remember that the dead can’t actually do any of this themselves because they are, in fact, dead. Instead, a trust is empowered to carry out the last wishes of the deceased.”

A trust, writes Konczal, “acts like a ghost, enforcing their wishes beyond the grave. But there’s a safeguard built in to prevent abuses: Trusts have been governed by something called the rule against perpetuities, which places a roughly 100-year limit on how long they can exist. This prevents people with no connection to the living world from putting restrictions on our country’s wealth.”

But there is a type of trust that keeps the estate’s funds tax-free long after the estate owner dies, called a “perpetual dynasty trust.” Twenty-eight states have them, and what they do should scare your socks off if you really care about America’s future. The reason is that dynasty trusts can avoid taxes as long as that dynasty trust exists.

“And since the eventual death of the trust isn’t built in, a dynasty trust can buy houses and assets that are retained for descendants, tax-free, by the trust indefinitely,” writes Konczal. “The wealthy can tie up their money, outside of any public obligation or scrutiny, forever.”

This handy guide from The Nation magazine explains it simply.

We all know that the wealthiest Americans already have too many tax breaks and large corporations have methods of legally avoiding them entirely. But it seems it’s never enough. Corporate-backed lawmakers keep handing out even more outlandish ways for the rich to avoid paying taxes without regard for how much harm it does.

If that doesn’t scare you, watch this truly shocking video to find out just what the super-rich are able to accumulate during their lives, and which – thanks to perpetual dynasty trusts – they can leave to their heirs, tax free, long after they’re dead.