Student debt is crushing working families. More than 43 million people carry an average of nearly $30,000 in student loan debt, including AFSCME members.

Many took on student loans to attain the skills and credentials needed to pursue jobs in public service. They are nurses, librarians, social workers, child care providers, and more. Yet their economic security is in peril: on average, borrowers spend nearly $400 a month toward student loan repayment.

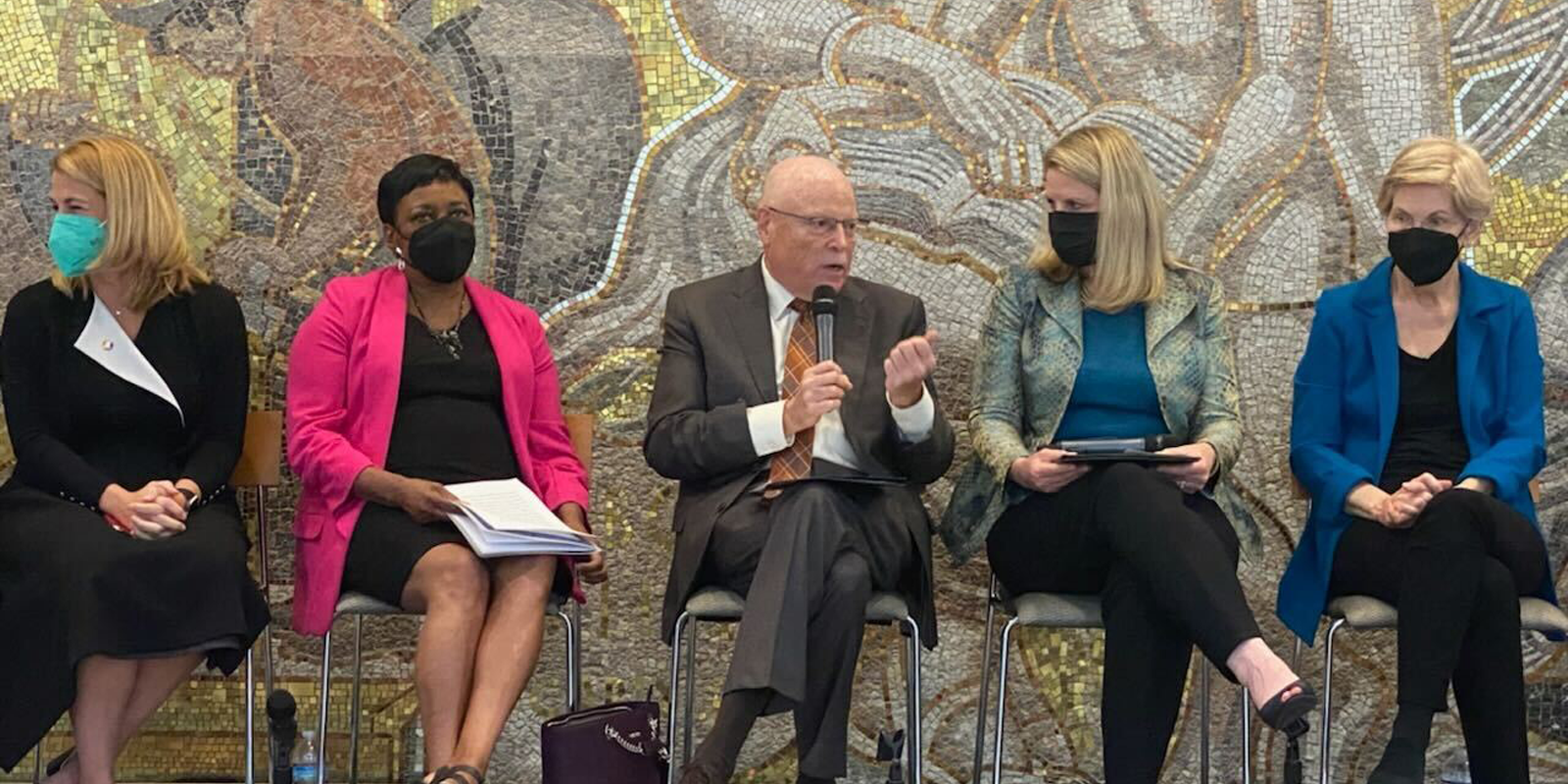

That is why AFSCME President Lee Saunders, along with AFL-CIO President Liz Shuler, Senate Majority Leader Chuck Schumer (D-New York), Sen. Elizabeth Warren (D-Mass.), Rep. Ayanna Pressley (D-Mass.) and other labor leaders called on President Joe Biden to provide across-the-board student debt relief during a roundtable talk on Wednesday.

“This is a priority for the trade union movement because it is a labor issue affecting millions of our members across the country,” Saunders said. “Working families are confronting a tidal wave of student debt and barely keeping their heads above water.”

He spotlighted the ways in which student debt is tied to income inequality.

“Women hold two-thirds of the country’s student debt. Black and brown people owe, on average, 80% of their original loan,” Saunders said. “And let’s push back on this back on this myth that student debt relief will only help Ivy League elites. That’s just a pundit narrative that doesn’t hold up to any scrutiny at all. The truth is that the folks carrying this debt are overwhelmingly working class.”

AFSCME members, Saunders said, want Biden to “go big” on student debt – “providing across-the-board debt relief, making the process as easy as possible for all borrowers, giving working families the hand up they need.”