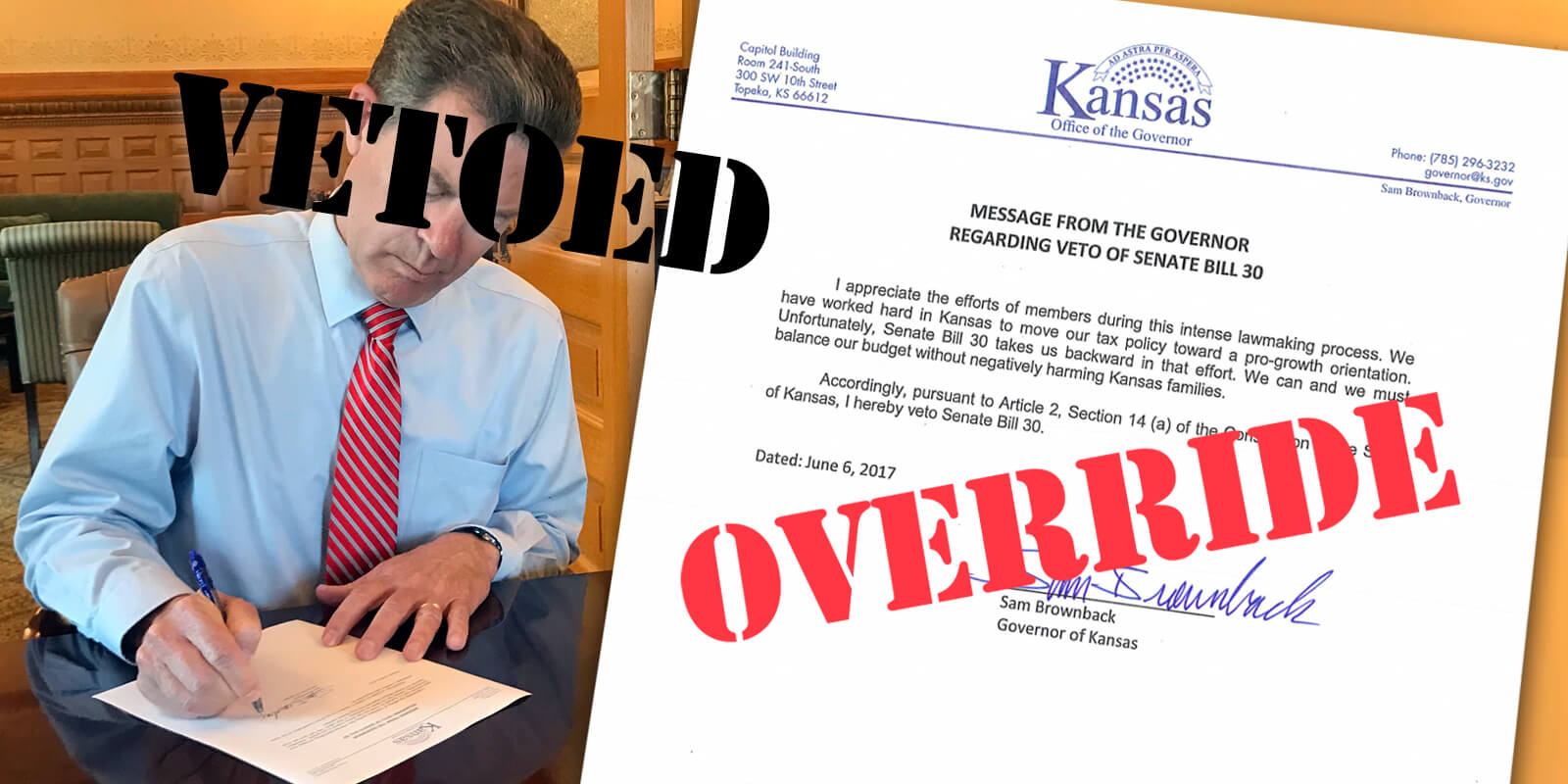

UPDATE: The Kansas Legislature has finally had it with the tax cuts and other unnecessary austerity measures pushed by that state’s right-wing governor. A bipartisan supermajority of Kansas lawmakers dramatically repudiated Gov. Sam Brownback's radical tax-cutting agenda. On Tuesday, they voted to increase personal income tax rates and raise revenue in other ways. They voted to override Brownback’s veto of a tax bill that’s expected to bring in $1.2 billion over the next two years and close a projected budget shortfall totaling $889 million through June 2019.

In 2012, Kansas Gov. Sam Brownback signed into law one of the largest tax cuts in the state’s history. He called it a “live experiment,” his very own version of trickle-down economics. And he did it despite opposition from members of his own party who feared it would bankrupt the state.

“We’ll see how it works,” he said.

It didn’t.

The fantasy of trickle-down economics tells a rotten story that’s been proven false time and again. It says that if you give rich people and corporations more money, even at the expense of public services, everyone will benefit.

It’s a fantasy that’s baked into President Donald Trump’s tax reform plan, which was written by the same economists who drafted Brownback’s. So how did the Kansan experiment turn out?

Since the Brownback tax cuts were implemented in January 2013, job growth has slowed down, gross domestic product is down and public infrastructure is in disrepair. If only we could stop there. But we can’t. The budget deficit has increased dramatically, the state’s credit rating has been downgraded, and there’s not enough money in the budget to properly fund even public education.

Also, while the wealthiest Kansans enjoyed a hefty rise in their incomes, the state’s poorest residents actually saw their tax liability increase. Those who make less than $25,000 a year now have to pay more in taxes, while those who make more than $250,000 a year have to pay less.

No wonder Brownback became the nation’s least popular governor. His radical strategy has succeeded in alienating many of the state’s working class residents, who may rightfully be wondering if they’re still in Kansas anymore.

Where did Brownback get such a crazy idea for tax cuts? His plan was based on model legislation published by the American Legislative Exchange Council (ALEC), a front group for wealthy special interests financed by two of America’s richest men, industrialists Charles and David Koch.

The fallout from Brownback’s excessive tax cuts continues. Some conservative members of the Kansas legislature are joining liberals to push back. This week, the legislature came close but failed to pass a tax bill that would’ve raised $1.2 billion over the next two years.

Kansas faces budget shortfalls totaling $887 million through June 2019. And in March, the state’s Supreme Court ruled that education funding is inadequate. Many are predicting that the end of such drastic austerity is near.

If there’s a lesson to be learned from the Kansan experiment, it’s that we should avoid trickle-down economics because it doesn’t work. And it could wreak havoc at the national level. In fact, it’s nothing more than what we’ve always suspected it was: a scheme to enrich the wealthy at the expense of everyone else.